The Pandora papers and Modi's failed promise of bringing back the black money

- Unmesh Gujarathi

- Oct 05, 2021

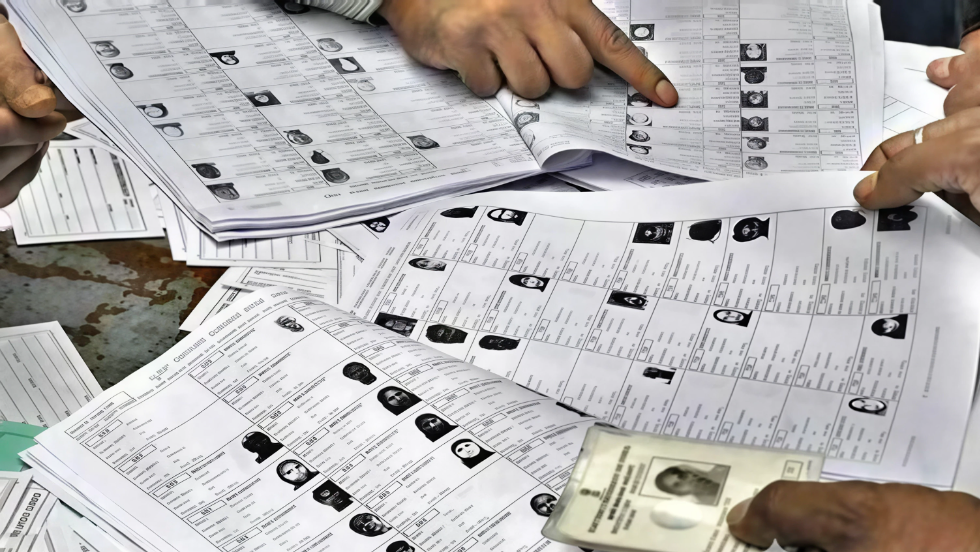

MUMBAI: After Panama papers, Pandora papers have now exposed Indian businessmen finding safe haven by forming foreign shell companies and opening Swiss Bank to stack their black money and Anil Ambani and absconding diamantaire Nirav Modi are the latest to join the list.

However, the moot point is, what is the government doing about it? Despite big announcements in a pre-2014 election speech, where Prime Minister Narendra Modi said will repatriate over Rs 12,000 crore of black money from the swizz account and give every Indian Rs 15 lakh. But what has happened, as per available information, over 422 cases have been said to have been filed under PMLA but has the money been recovered and bought in India?

The recently leaked Pandora papers expose that has been unrevealed by the Indian media houses puts focus on the modus operandi used by key Indian businessmen and high-profile investors to defraud our banking system of thousands of crores of rupees. The modus operandi seems to be simple. They first set up a trust in an overseas destination, the purpose of which is to cover up their true identities, which enables them to distance themselves from the offshore entity and evade the tax dragnet. The custodians of such trusts are third party administrators who also act at the legal counsels of these people.

The trust set-up turns out to be an arrangement by which a third party or say a trustee to be in charge of assets and act on behalf of individuals or organizations that will be its beneficiary. Big business houses and families use the trust route to consolidate their financial investments, shareholdings, and real estate holdings. Any trust created comprises three key components or parties as to the legal parlance mentions. Firstly, the person who sets up or creates the trust or settlor; secondly the person who holds the assets for benefit of a third-party, namely trustee; and thirdly the beneficiaries to whom the benefits of the assets accrued.

In the Indian context, however, this option is being utilized by businessmen who declare bankruptcy and siphon their assets to foreign destinations, where the trust set up helps them avoid punitive action from their creditors, namely the nationalized, co-operative and private banks. Indian laws consider any trust as an obligation of the trustee to manage the assets on behalf of the beneficiaries. Besides, under Indian law, trusts are set up in offshore jurisdictions to find recognition. However, the law does not take the view that any trust is a legal entity.

The standing example when it comes to the Indian context was cited in media as that of Nirav Modi who managed to flee the country after defaulting on a huge corpus of payment to the now scam-tainted Punjab National Bank (PNB). Having defaulted on a huge sum, within months after his shifting residence to foreign soil, Nirav's sister set up a trust, by means of which the appointed trustees would act on and manage assets for the benefit of this absconder. To understand how this arrangement works, it would suffice to say that the trustee who acts on behalf of Modi as his beneficiary might be in control of several thousands of crores of rupees worth assets. While Modi having defaulted on the bank loans will stand to lose only a few hundred crores after the bank attaches his properties and assets held in India. Furthermore, the bank or even the courts do not have the jurisdiction to seize the funds or assets that are held by the trust of which he happens to be a beneficiary.

The arrangement does not necessarily warrant the defaulter to flee the country or say even shift residence to an undisclosed destination. To cite another example, Anil Ambani has declared bankruptcy after availing several thousands of crores of bank loans. The trusts that are operating on foreign soil for his benefit are beyond the reach of Indian legal jurisdiction.

Much stronger and revealing than the Panama papers, the Pandora papers shed light on not only rich but also notorious defaulters, who are currently facing the scan from both nodal and state-level investigative agencies. The problem posed for any of our nodal agencies aiming at unearthing evidence about such a multi-layered trust structure is that air-tight security laws shroud its transactions.

Post the arrival of the Panama papers, nations across the globe tightened up regulations that govern offshore business entities. As usual the criminals always have to be two steps ahead of the law enforcers. Consequently, the Pandora papers have shed light on how business entities and celebrities or people of fame circumvented the legal system by using the trust route. Besides tax evasion, it also is a matter of grave concern in the areas of terror funding and money laundering.

Reporter

Unmesh our Editor-at-large is one of the most prolific editors with a career that spans over two decades in leading media houses like The Asian Age, The Free Press Journal, Lokmat etc. Currently, he is the Editor-in-Chief of Sprouts, a daily broadsheet. Unmesh is particularly known for his exposé that have unearthed major scandals of corruption and scoops.

View Reporter News